Kevin Ellis illustrates Horse Cove Partners option trading performance relative to the S&P 500 Index

Horse Cove Partners LLC uses a multi-component proprietary investment process to profit from the “art and science” of taking risk.

The science of what we do is based on a modified Black Scholes model. This takes into account the market movements at given levels of volatility in a given period of time. We then apply our rules-based investment criteria to the decision of where to write (sell) puts and calls on the S&P 500 index.

Utilizing our investment formulas, the investment committee establishes the risk level we are willing to assume in a given week.

We also carefully adjust our collateral usage week-to-week to maximize profits; while maintaining an effective level of margin in the event that the market should move against our positions.

The art of what we do is the effective management of risk after positions have been established. While the risks of our positions expiring “in the money” are remote, it does not mean it could not, or will not ever happen. While we make little effort to predict the path of the market, we do monitor all of our option positions with an eye to the impact on margin calls, profit, and mitigation of potential losses at what we feel are acceptable levels. The trading of options is speculative and can lead to significant losses. We never simply take on risk and then wait to see what happens. On the contrary, we are constantly vigilant of risk of success and loss and will make adjustments to the portfolio to reduce potential risk and effectively manage margin with our broker.

We also utilize protective puts on all of our positions. That caps the ultimate loss that may be sustained with open positions and helps with portfolio margin. However, that cap will in no way prevent a loss of a majority of equity should an event occur that moves the market in an unexpected or catastrophic way.

We use S&P 500 Index Options to write our options for a number of very important reasons:

- We eliminate single-issue events. While any given company can be great at one point in time, we do not want to have the risk, for instance, that the CEO will be diagnosed with some fatal disease or the news that a division is being charged with bribery in a foreign land only to have the stock suddenly drop. By investing in options on the top 500 companies contained within the S&P 500, we eliminate that single risk and get a blended risk exposure to the market which is more predictable and stable.

- S&P 500 Index Options are “European” style. That means that they only can be exercised at maturity. No matter what might happen during the week, the only point in time at which settlement can be made is at expiration. This is an important distinction from other options because it gives us a fixed point in time against which to measure risk. Even if a “flash crash” were to occur, European style options cannot be exercised until expiration.

- S&P 500 options are cash settled. That means that at expiration if the options are “in the money”, the obligation to pay is not the total value of the market multiplied times the number of option contracts, but rather the difference between the settlement price and the strike price of the options. One option contract does not have a value of 100 times the value of the S&P 500 index. It has a value of 100 times the price that it settles at in the money. If it settles out of the money its value is zero.

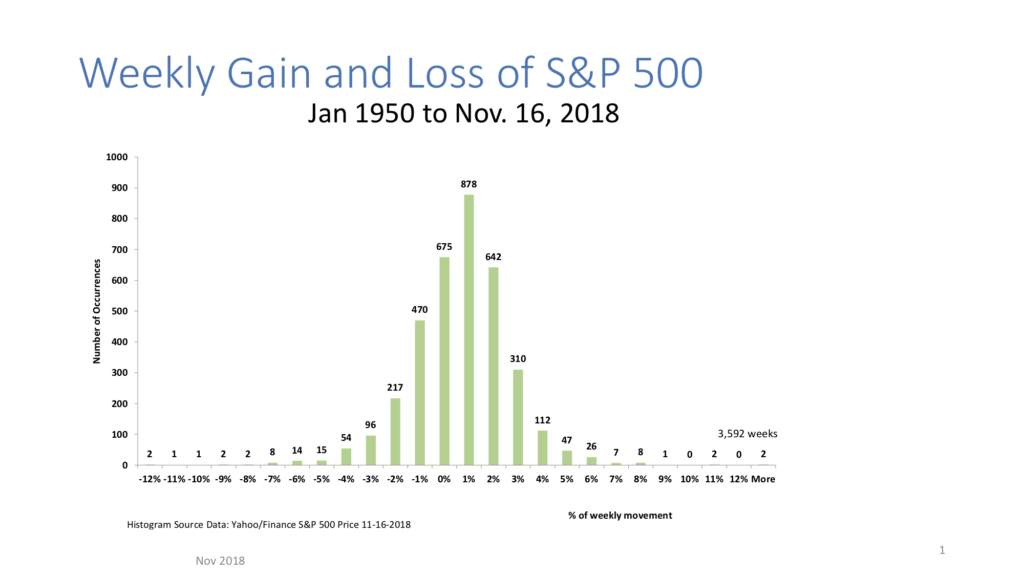

Historically, the market is a surprisingly stable place only moving +/- 5% in any given week for the last 60 plus years, 96% of the time.

The inputs into our strategy are:

The daily mean and standard deviations of:

- Time to expiration

- Volatility as measured by the VIX

- The current level of the S&P 500 index

- The current interest rate

- Current dividend yield

- The percentage "out of the money" the option contracts are written.

Based on those inputs, aligned with our established rules on acceptable risk levels we sell options, both puts and calls gathering as potential profit whatever the market will bear.

As a general matter, the higher the volatility, the larger the premium that can be received for a given level of risk, and the farther out of the money the contracts can be written. Conversely, the lower the level of volatility results in the premiums being smaller and the contracts will be written closer to the index.

Our put and call writing strategies can be viewed metaphorically as selling a form of insurance whereby we, as the option seller, collect the premium up-front from a buyer who is looking to hedge or otherwise protect their exposure to the market. If the event hedged or “insured” does not occur, then we keep the premiums as profit. The incremental profit collected from selling these options add up to real, absolute return for our clients.