The month-end performance estimate as of May 31, 2014 for Horse Cove Partners Absolute Return Strategy is +2.39%, net of fees1. For 2014 year to date, the strategy return is +5.29%, and since the inception of trading in December 2010, the strategy has achieved a total cumulative return of +147.61%.

Market Recap and Commentary

May was benign, and there appears to be little fear in the market. With volatility below 14 most of the month, premiums remain light. On the positive side, with no significant market movement, there was little margin pressure and we were able to keep most of what we collected selling positions.

With respect to the low level of volatility: Goldman Sachs Group Inc. (GS) President Gary Cohn said recently that low interest rates and the Federal Reserve’s program of quantitative easing have resulted in reduced volatility. He pointed to the Chicago Board Options Exchange Volatility Index, a gauge of U.S. stock volatility known as the VIX, which is now trading 40 percent below its historical average.

The VIX declined over 16% during the month, closing the last week of trading at 11.40%. To put that low level in perspective, the weekly VIX has spent only 9.3% of the time at a level below 12% in the last 24 years. Take a look at this historical chart of volatility…

The S&P 500 steadily rose during the month, trading in a narrow range. Here are the daily highs and lows for the month of May:

At a macro level, as Mr. Cohn noted above, the results of abnormally low interest rates and the printing of money by the Fed continue to force the search for yield in the marketplace, and as a result have dramatically shrunk volatility as the markets have steadily risen. Given the state of economic affairs in the United States, having just printed a negative GDP for the 1st Quarter, the apparent slowdown in China and Europe, moving away from centralization in its recent voting, we don’t believe the market is correctly weighing volatility.

Performance and Trading Update

Trading was pretty calm this month with 4 trading cycles of putting positions on, then taking them off when we could for a nickel. We averaged $0.625 gross premium each week. The last week of May heading into the Memorial Day Weekend, traders were few and far between. It was the first time, in many months that we did not sell any call spreads, the risk--just not worth the reward.

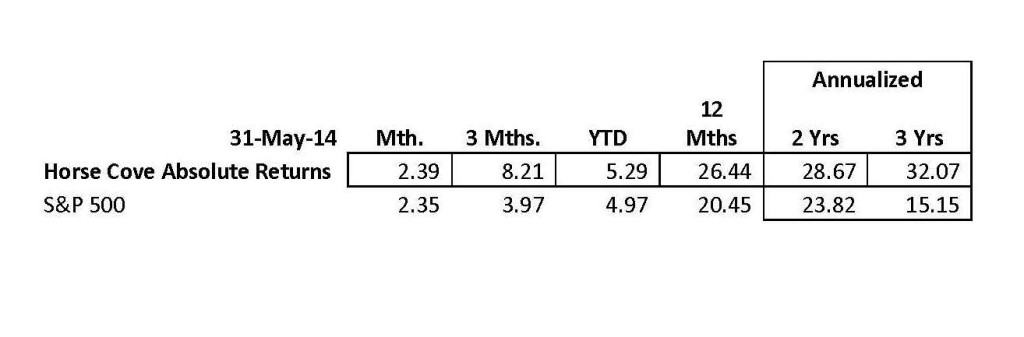

Here are the returns versus the S&P 500 for the periods indicated:

During the month, we sold puts at an average of 4.75% out of the money and calls at 2.6%. That is closer in than the previous month and directly reflects the decline in volatility, one of the main inputs into our trading models. When volatility is low, our models call for trades closer in the money to the strike price in order to maintain a consistent risk profile from week to week.

Reducing Potential Risk

At Horse Cove Partners, we trade index options on the S&P 500. One of the keys to our success is focusing on risk and attempting to reduce it or at least understand it whenever possible. One of the nuances to this is the decision to trade index options versus options on individual stocks.

When you sell put or call options on a stock, you have what is known as a single issue risk. In addition to the overall risk of the market, the trader is exposed to the risk unique to that one company and the potential news of the day. A few examples of this include a senior company official’s health, a product recall, or a data breach by hackers. Recently, the CEO of Target resigned after a massive data breach was uncovered and the stock dropped 2.89 % in single day on May 5, 2014. That drop occurred even though shoppers continue to buy at Target and there was a full management team in place months after the data breach was revealed.

While Target remains a great company, if you were holding short term put options that day, you would have been exposed to the news of the day in addition to the general news that effects the market. Single issue risk adds complexity to the pricing of an option and makes calculation of the risk that we as a seller, are taking on much more difficult and reduces the confidence we have in taking on that risk.

Index options represent the aggregate prices of all 500 stocks that make up the S&P 500, so while there is single issue risk affecting each company that makes up the index, that risk is spread and balanced across that same group of companies. This exposes us to the general risk of the market and reduces one layer of probability that something could happen. We have more confidence taking on the risk of the market than the risk of the market and the news than could impact an individual stock.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets, and is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder and Kevin Ellis

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis as of 5.31.2014, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.