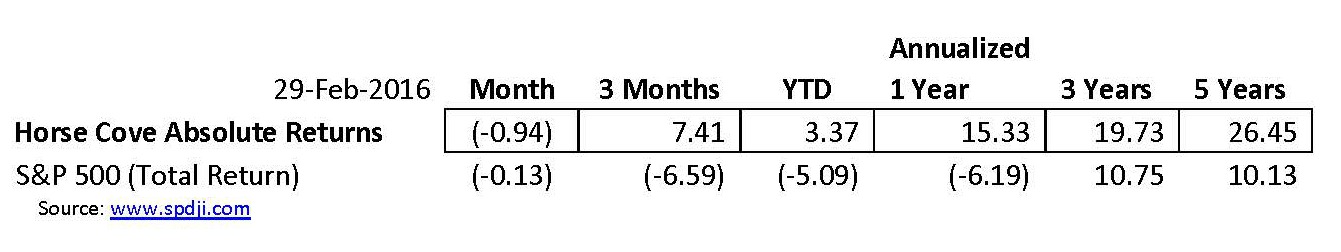

The February 29, 2016 month-end performance estimate for the Horse Cove Partners Absolute Return Strategy is -0.94%, net of fees1. Since the December 2010 inception of trading, the Strategy has achieved a total cumulative return of +225.39%.

Market Recap and Commentary

The S&P 500 Total Return Index declined (-0.13%) for the month and ended February down (-5.09%) year to date.

In February, the market retested its lows for the correction putting in a lower low for the S&P 500 at 1810.10. From there, the S&P 500 rallied hard to close out the month near its high of 1951.83. Even with the rally, the S&P 500 is still down over (-8.0%) from its peak.

Volatility (VIX) ranged from 19.98% to a high of 30.90% on Feb. 11 and closed the month at 20.55%. There have been only 4 days so far this year where the VIX has been below 20%.

Performance and Trading Update

For the month, the Horse Cove Absolute Return Strategy composite return was down (-0.94%) compared to the S&P 500 Total Return Index, that was down (0.13%).

The market rally during the short President’s Day week proved a challenge for the calls we had written. On Wednesday, even though the market never rallied past the strike price on the calls we wrote, our risk mitigation discipline required that we buy them back. The resulting loss wiped out what had been a good month to date. However, the remaining couple more weeks of trading produced positive results and the strategy was able to almost break even for the month.

It is a fundamental philosophy of ours in exiting a trade, that it is better to take “intelligent losses” when the trade is not working our way in order to preserve as much of the capital as possible, in order to write again. While it is frustrating to take a loss when the market seems to inevitably turn the other way after we take defensive action, we believe that turning to a strategy of “hope” when the trade appears to be going against us, has the potential risk of a catastrophic loss

that we are just not willing to take with our client’s assets.

IRA Update

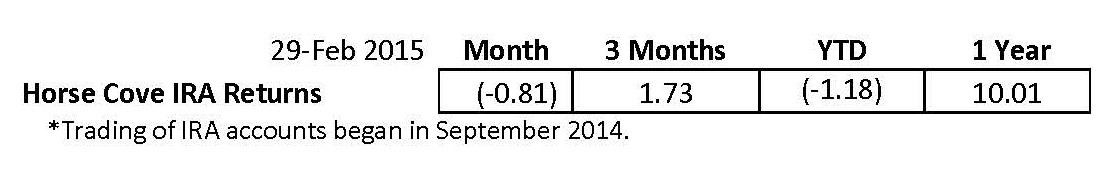

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Bulls, Bears and Absolute Returns

Are we, or aren’t we in a bear market? Has the bull ended, or is there more to come? These are some of the questions investors are asking with the market dropping at its worst in February (-15.2%) from its all-time high. It becomes an important question to answer for both the buy and hold investor and investors seeking to time the market. The answer may spell out how long it may take to get back to the market high, or how much of gains will be preserved.

Looking back at the Dow Jones Industrial Average since 1901, the DOW has spent 76.4% of its time either declining in value, or recovering from declines. (Source: Tim Price, CFA writing for OP 8 Analytics LLC, Jan. 25, 2016). Only 23.6% of the time has it been creating new wealth for the buy and hold investor. That is only 26 years making new highs and 87 years declining or trying to recover. Over the past 100 years, the inflation adjusted return of the S&P 500 is an annualized growth rate of 1.78%. (Source: A Perspective on Secular Bull and Bear Markets by Don Short, March 1, 2016).

Since 1877 to March of 2009, secular bull markets have averaged +415% in returns whereas secular bear markets losses have averaged -65% (based on inflation adjusted S&P 500 Composite averages of daily close). (Source: A Perspective on Secular Bull and Bear Markets by Don Short, March 1, 2016). The last two bear market declines ending in 1982 and 2009 were -63% and -59% respectively. The last two secular bear markets lasted 13.6 and 8.5 years respectively. If we are entering another one of those bear market periods, we may be looking at an S&P 500 index level of about 832 at the bottom. Using those assumptions, once we get to the bottom, the buy and hold investor will need to achieve gains of +156% just to break even with the market peak.

Contrast the average length of the last two bear markets of 11 years with the Horse Cove Partners Absolute Return Strategy that is taking one bite of the market, a week at a time. Since the market peak in May of 2015 through Feb. 29, 2016, our trading strategy has achieved total cumulative returns of 10.44% while the S&P 500 Price index has declined (-9.47%). Whether in a secular bull or bear market, we believe there is a legitimate place and compelling reasons for an absolute returns strategy to be part of a diversified portfolio, versus the alternative of possibly waiting 11 years trying to break even.

About Horse Cove Partners LLC

We want to welcome Don Trotter to the Horse Cove Partners Team. Don joined us from Atlantic Assets Management where he was a Managing Director and Founder. At the time of it sale last year, they had $7 billion of assets under management. Throughout his career at Atlantic, Mr. Trotter was instrumental in developing and implementing its strategy of investing in and developing emerging investment management firms specializing in non-traditional assets classes. Don is a CFA and resides in Kansas City, Missouri.

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of February 2016 were $21.253 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan

Michael Crissey

Greg Hyde

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

ghyde@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 2.29.2016, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.