The month-end performance estimate, as of October 31, 2015 for Horse Cove Partners Absolute Return Strategy is -1.96%, net of fees1. Since the inception of trading in December 2010, the Strategy has achieved a total cumulative return of +192.21%.

Market Recap and Commentary

The market put in the best month in the last four years rising over 8% in October. This on mediocre earnings results and little other changes in the overall US or global economies. However, the Federal Reserve again passed on the opportunity to raise interest rates.

The VIX opened the month at 23.14%, hit a peak of 25.23% the same day, and then fell the remainder of the month to close at 15.07%.

As of October 31, 2015, the S&P 500 has returned to positive territory up 2.70% year to date, but still down (2.6%) from its peak on May 21, 2015. In comparison, the Horse Cove Absolute return Strategy is up 11.78% year to date.

Performance and Trading Update

For the month, the Horse Cove Absolute Return Strategy composite returns were down (1.96%) compared to the S&P 500 Total Return Index that was up 8.44%. Since the beginning of the year, the Horse Cove Strategy is up 11.78% versus the S&P 500 up 2.70%.

During the month, we had to take defensive action on call positions in two different weeks. As a result, the month ended down. Historically, we have seen volatility spike up and then drift down. We got the spike on August 24, 2015, but volatility has been quick to return to under 20%. It took only 29 trading days for volatility to spike over 40% and return back under 20%.

In comparison, in 2011, the last time we saw that kind of spike in volatility, it took over 6 months for the VIX to return back below 20%.

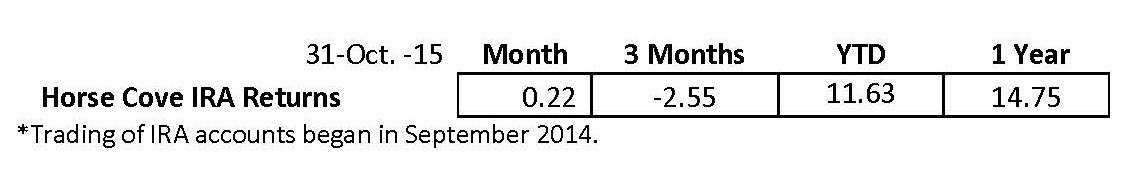

IRA Update

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Warning Signs

We make it very clear that we don’t attempt to predict where the market is headed day to day. That does not mean that we don’t pay attention. We follow authors and investment professionals that attempt to make reasoned prognostications. We know that all of our clients have other traditional investments and may not have access to the resources we review regularly.

From our vantage point, we thought we would share with you the warning signs that we are seeing that could possibly affect the markets going forward. We have linked the comments to help explain why each event is happening.

- Janet Yellen’s recent speech makes it look very likely that the Federal Reserve will ceremoniously raise rates at the December meeting, but will continue its policy of cheap money with very low interest rates.

- Over the weekend, Financial Times said 2015 is shaping up to be the biggest year ever for global deal making.

- With close to $4 trillion worth of deals already announced this year, 2015 is on track to beat the all-time record of 2007. Due to very cheap money, (see #1) these “deals” are being done to “buy” earnings. The credit bubble in 2007 helped generate $4.3 trillion worth of transactions. We know what happened in 2008 and 2009…

- The US just raised the debt ceiling for the 75th time. The total debt of all countries in the world is slightly over $61.2 trillion. The United States has 4.4% of the world’s population, generates 23.2% of global GDP, and owes nearly 30% of the total global debt. US Government debt, as a percentage of GDP, is now 101%. US Government debt has grown six fold since 1990, twice as fast as the US economy. Government debt has more than doubled in the past decade, going from $7.3 trillion in 2004 to more than $18 trillion today. But due to the cheap money created by the central bank, total borrowing costs have only increased by 34%. (again see #1).

- Average corporate earnings margins now exceed 10%. (see #2) In the past 60 years they have never exceed 8.5%, until now, and the two times they averaged over 8%, a bear market soon followed.

- The world’s largest container shipping company is cancelling 39 voyages, laying off 4,000 people and cancelling orders for new ships in what A.P. Moeller-Marsk A/S calls, “a sharp down turn in shipping”. This is the deepest market slump in the industry since the market bottom in early 2009.

- Activity in China's manufacturing sector unexpectedly shrunk for a third straight month in October, an official survey showed on Sunday, fueling fears that their economy may be cooling further in the fourth quarter despite a raft of stimulus measures. (see #6)

- Per Reuters, South Korean exports slumped the most in more than six years in October, with hefty drops in shipments to China, the United States and Europe. This suggests a further weakening in global demand. (again see #6)

- The US Labor Participation Rate has fallen to 62.40%, the lowest in 38 years.

It seems to us, that each of these observations point to unsustainable trends that do not support a rising stock market. These must certainly be rationalized at some point in the future, perhaps soon.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of October 2015 were $17.7 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan, Michael Crissey and Greg Hyde

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

ghyde@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 10.31.2015, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.