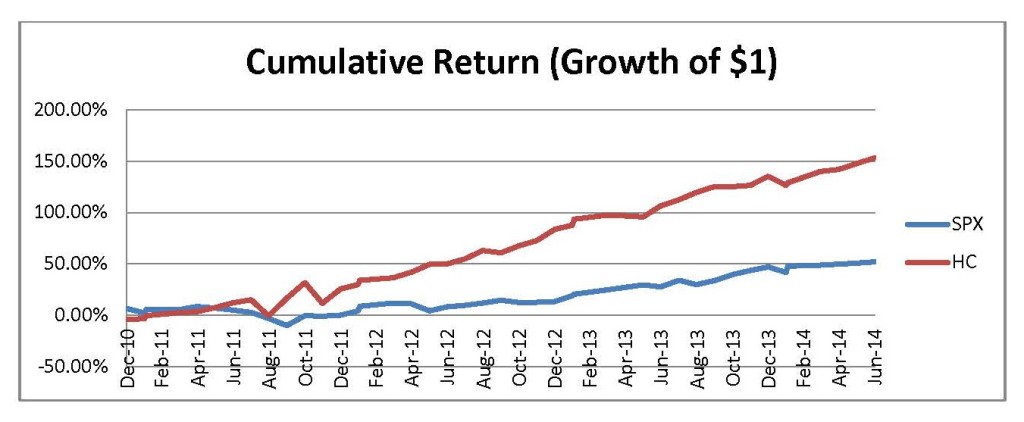

The month-end performance estimate as of June 30, 2014 for Horse Cove Partners Absolute Return Strategy is +2.26%, net of fees1. For 2014 year to date, the strategy return is +7.67%, and since the inception of trading in December 2010, the strategy has achieved a total cumulative return of +153.21%.

Market Recap and Commentary

The old Wall Street saying of “sell in May and go away”, proved to be bad advice this month as June posted a good month of gains, up over 2%. “Free” money and the demand for yield continue to drive the market higher. The annual yield on a basket of stocks such as those comprising the S&P 500 is now 2.05% per year. That compares with a 1 year treasury yield of 0.11%, according to BankRate.com. Stocks are now being sold to anyone looking for return, as just about any dividend produces more “yield” than government bonds. However, looking deeper, the sellers are the large institutional players and the retail investors are the buyers, and we should all take notice of that fact.

Rates of return are so low, in Europe they have embarked on negative interest rates (the depositor must pay the bank to hold the money). Here in the US, an advertising piece from American Express caught our eye. It said that the average yield now being paid by the top 50 banks in the US is now 0.07% APR. (Annual Percentage Rate), and proudly pitching their 0.80% APR as the place for yield. With inflation somewhere north of 3% in real terms, investors are being pitched on losing almost 3 % per year to lock up their money with the “big” banks.

We have a better idea, for those seeking yield!

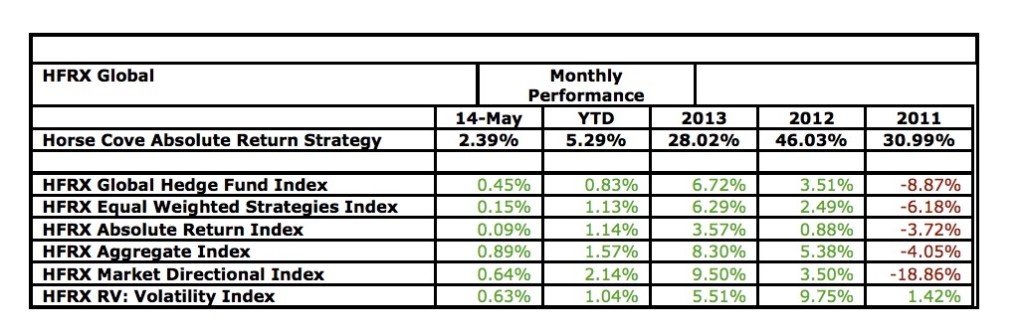

Banks are not the only ones falling short on returns. We present without further comment, the alternative index returns of hedge funds as reported by HFRX for the month of May compared to the Horse Cove Absolute return strategy:

Performance and Trading Update

Trading was again relatively calm during the month. We saw new lows reached in volatility with the VIX trading below 10.50% during the month. The month provided us with 5 opportunities to write contracts with the last week ending on July 3, so we had mark-to-market at month end on those open positions. Fortunately it was positive. We sold puts 5 times and calls 4 times during the month. We averaged $0.58 of gross premium each week.

Here are the returns versus the S&P 500 total return index for the periods indicated:

During the month, we sold puts at an average of 4.3% out of the money and calls at 2.4%.

Here is the cumulative growth of the strategy since inception as compared to the S&P 500 Index:

Correlation

One of the most widely accepted investment “rules” is to “diversify your portfolio”. Properly done, diversification lowers the risk to the portfolio by reducing portfolio volatility. In its simplest form, what this means is “do not have all of your assets in the same security or the same asset class.” (i.e., do not only own Google or only own Large Cap US equities.) By adding bonds, real estate or other assets to an equity portfolio, you reduce your portfolio volatility because the other assets do not move (perform) exactly like equities. (They are not perfectly “correlated” to each other.)

Correlation is a measure of how closely the movements of one asset mirror the movements of the other. Any asset (or asset class) with a correlation number from 0.0 to -1.0 will lower portfolio risk (volatility). An ideal asset for diversification is one which increases your portfolio return and does not increase your portfolio risk (volatility).

Fortunately, adding the strategy offered by Horse Cove Partners to your portfolio does that—improves the total portfolio return with close to zero increase in volatility. Relative to the S&P 500, the correlation for the Horse Cove Partners strategy is +0.03. Because Horse Cove has significantly outperformed the S&P 500 for the past three years, adding Horse Cove to your portfolio mix would have improved return without increasing risk.

An illustration of how much additional performance you could have achieved is:

A $1,000,000 portfolio 100% invested in the S&P 500 on May 31, 2011, would have produced an ending asset value of $1,584,427. Shifting 25% ($250,000) of the $1,000,000 portfolio to the Horse Cove strategy would have produced an ending value of $1,827,135, an increase over the three years of $242,708 without significantly increasing risk!

Put another way, we are taking a market risk (one roughly equivalent to investing in the S&P 500), but producing significantly higher annualized returns. Over the same three year period, the same $1,000,000 investment in the Horse Cove strategy would have yielded $2,555,619.

If you would like to learn more about how we can produce these returns for your assets, please contact us at info@horsecovepartners.com.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets, and is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder and Kevin Ellis

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis as of 5.31.2014, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.¬