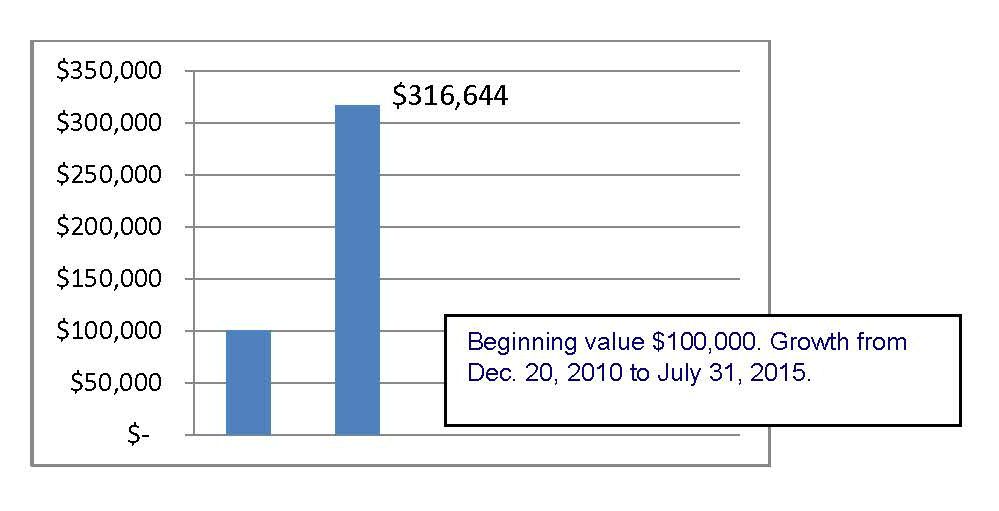

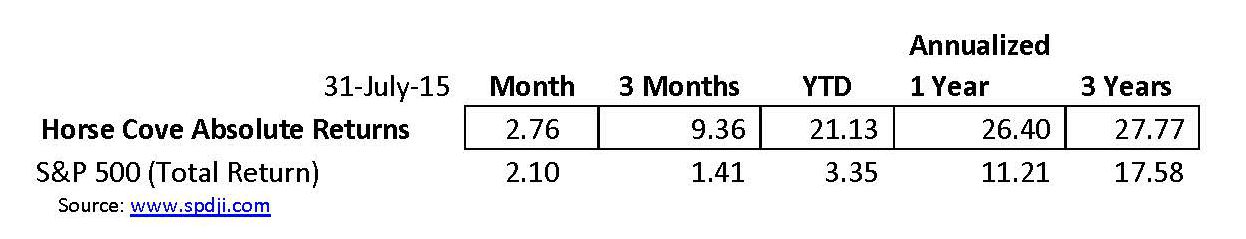

The month-end performance estimate, as of July 31, 2015 for Horse Cove Partners Absolute Return Strategy is +2.76%, net of fees1. Since the inception of trading in December 2010, the Strategy has achieved a total cumulative return of +216.65%.

Market Recap and Commentary

The S&P 500 Total Return Index made a positive recovery for the month, up 2.10% which added to the slight gain for the year to date, now up 3.35%. (Horse Cove is up 21.13% year-to-date). This, as the economy of Greece appears to be swirling the drain, Puerto Rico has defaulted on its $72 billion of municipal debt and China saw its stock market drop more than 14% during the month.

Generally speaking, the market tops about every 7 years. The last top was 2007. The S&P 500 has more than tripled from its March 2009 lows. It has been nearly 4 years since the market declined by more than 10% (officially a “correction”).

The rapid rise and fall of the volatility could be signaling a market top and the prospect of a correction. Volatility had a couple of spikes during the month. On July 9, the VIX hit 19.97%. That is the highest it has been in the last 6 months. The VIX has not been above 20% since January 30, 2015.

Performance and Trading Update

We were able to take advantage of the spikes in volatility to capture solid premiums this month. There was little margin pressure again this month even with the spike the last week of July.

The strategy continues to handily out-perform the S&P 500 Total Return Index in all of the periods indicated:

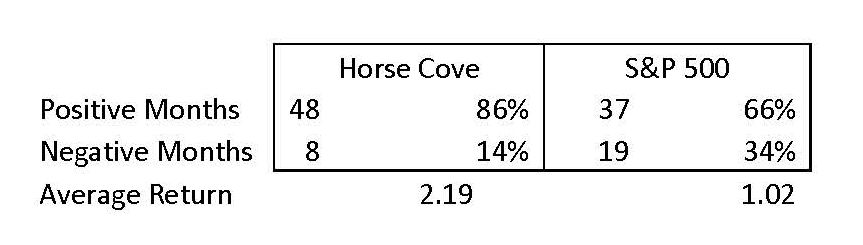

The steady returns of the strategy, in up and down markets, continues to add to overall performance gains over most other assets including the S&P 500. Even in a “bull market”, the S&P 500 has had negative returns in a third of the months since Horse Cove began trading.

IRA Update

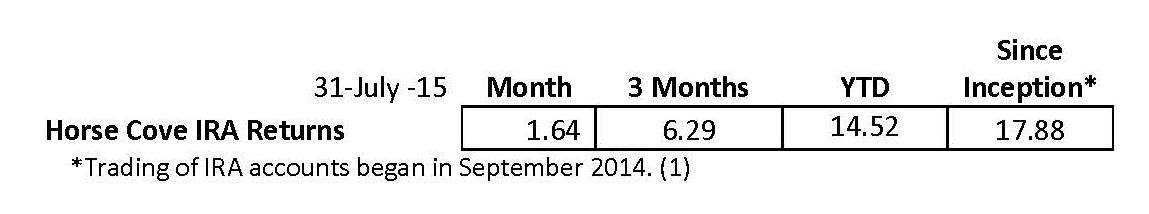

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Is The Reward Worth The Risk?

Are you a conservative investor who just wants 6% or 8% per year…one who doesn’t want to swing for the fences but just wants to get on base? We encounter a number of prospects who view what we do as trying to hit home runs when they just want to get on base.

Mark Morgan Ford who writes for the Palm Beach Research Group admitted recently that for years he was an extremely conservative investor who would rather invest having a “great likelihood of making a modest profit, rather than a modest likelihood of making a great profit. “ He now admits that he has been too conservative after considering what a small allocation to an outperformer could do to his overall portfolio. His conclusion was reached after looking at the facts and studying the work of Peter Lynch.

Peter Lynch is considered one of the greatest investors on Wall Street. He has unquestionably great skills at the common sense identification of opportunities and solid financial analysis. But the secret to his ability to outperform the market was his including some big winners in his portfolio that were able to make huge gains. What he called “ten-baggers”.

In the footsteps of Mr. Lynch, we believe that the reward of adding a small allocation to the Horse Cove Absolute Return Strategy is well worth the risk and can boost the conservative investor’s profits while maintaining, if not increasing, the portfolios overall safety. Here’s why:

Investment Strategy A: $1,000,000 in a conservative 60/40 portfolio (60% equities and 40% bonds) starting on January 2, 2011 through July 2015. We will use Vanguards Balanced Fund as a proxy (ticker:VBINX).

Investment Strategy B: $1,000,000 with 90% in the above conservative portfolio and 10% in Horse Cove for the same time.

Following Investment Strategy A--you would have made 53.65% over the 4 ½ years ending in July 2015.

Following Investment Strategy B--you would have made 69.94% over the same period of time. That is almost 30% more return. In dollars, $1 million would have grown to $1.536 million under Strategy A, while with the addition of Horse Cove, the $1 million would have grown to $1,699 million. An extra $163,000.

What about the risk? All investments entail risk. The Horse Cove Absolute Return Strategy is not correlated to stocks and bonds. That means under normal historical market conditions, the Horse Cove Strategy will not move in tandem with the other investments and should supplement a conservative investment strategy, as has been the case for the last 4 ½ years. We also see that in the difference in number of positive and negative months noted above.

However, the frequent question that is asked is about an extreme. For example, “What if the market just dropped 20%?” We call this the “Zombie Apocalypse Scenario.” On a given day, something happens that has never happened before, and the market just drops 20%. The circuit breakers are not implemented…the Government does not halt trading (as was done after 9-11)…Everyone at Horse Cove is consumed by zombies. Simultaneously, the zombies attack everyone at Interactive Brokers globally so they also do not take any action to liquidate positions, but the rest of the exchanges remain open and trading goes on with no disruption.

There are two extreme possibilities: First, if it happened in August, 2015, Investment Strategy A would have $1,228,800 left. With Investment Strategy B, under an assumed Zombie Apocalypse Scenario, we would assume a 100% of the assets allocated to Horse Cove are lost. But at the end of the day, the portfolio would still be $1,106,257.

Second, if it happened on day one, Investment Strategy A would have $800,000 left and under Investment Strategy B there would be $720,000 left. If the Zombie Apocalypse Scenario occurred somewhere between day 1 and August 2015, the values would be adjusted somewhere in between.

In either case the downside risk to the total portfolio is not significant compared to the additional annual return that can be achieved. Horse Cove’s Absolute Return Strategy continues to produce returns that substantially exceeded all major indices and all but a handful of all other managers, regardless of investment style or asset class.

Horse Cove Update

Horse Cove Partners was ranked as the third best Option Strategy by BarclayHedge for June. This makes 10 consecutive months of performance award rankings from them. As of June, the year-to-date returns of Horse Cove are double the second best option strategy in the rankings.

Total assets under management now exceed $18.3 million in the Horse Cove Absolute Return Strategy.

We value each of our clients and the assets each has entrusted to us in our Strategy. We will continue to pursue attractive returns to the benefit of all.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan and Michael Crissey

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 7.31.2015, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.