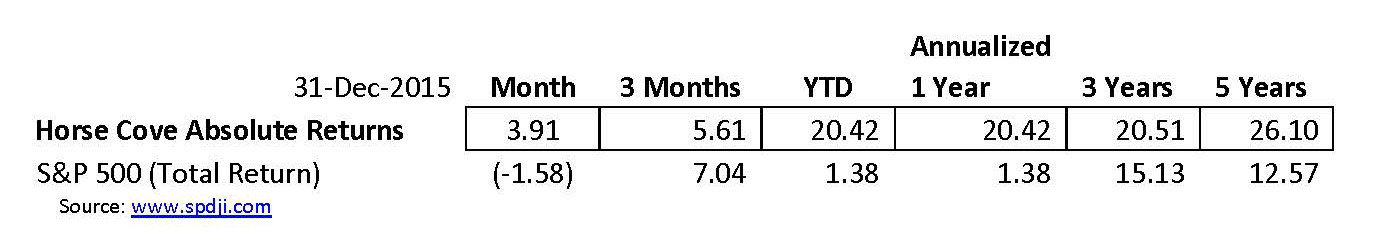

The month-end performance estimate, as of December 31, 2015 for Horse Cove Partners Absolute Return Strategy is 3.91%, net of fees and 20.42% for the year1. Since the inception of trading in December 2010, the Strategy has achieved a total cumulative return of +214.81%.

Market Recap and Commentary

The S&P 500 Total Return Index declined (-1.58%) for the month. This left an investment in the S&P 500 Index including dividends with a slight gain for the year of 1.38%. If you exclude dividends, the S&P 500 Price Index declined (0.73%) for the year. In comparison, the Horse Cove Absolute Return Strategy is up 20.42% for the year.

The VIX opened the month at 15.41%, hit a peak of 25.27% in the middle of the month, and then fell into month end closing at 20.70%, setting up a volatile start to 2016.

In reviewing the year, the average daily closing VIX in 2015 was 16.67%. The high was 53.29% on August 24, 2015 and the low was 10.88% on August 5, 2015.

Where are the markets headed? Not sure! The saying on Wall Street is … “As goes January, so goes the year.” Last year, the S&P 500 was down (-3.0%) in January. The market opened down dramatically lower in 2016. Fortunately, the Horse Cove Absolute Return Strategy is focused one week at a time and is not dependent on our ability to predict the direction of the market.

Performance and Trading Update

For the month, the Horse Cove Absolute Return Strategy composite returns were up 3.91% compared to the S&P 500 Total Return Index that was down (1.58%).

December has historically been a good month for the strategy with average monthly returns over the past 6 years of trading in December of 4.77%. We had a small spike in volatility on December 11, 2015 with an inter-day high of 25.27, however, no defensive action was necessary during the month.

IRA Update

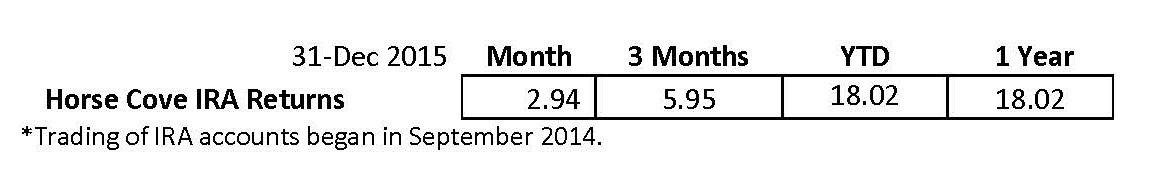

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Something is Working!

Horse Cove Partners closed another strong year, out-performing a traditional investment of stocks and bonds by a wide margin. Bloomberg Business ran an article on December 28, 2015 titled “The Year Nothing Worked: Stocks, Bonds, Cash Go Nowhere.” We beg to differ. “Something” continued to work very well, with average annual returns for the last 5 years of 26.56%! Horse Cove Partners Absolute Return Strategy.

The key points of the article were:

It was the worst year for asset allocation since 1937; and

That the modest gain in the S&P 500 was roughly the best anyone could do.

This is the trillion dollar investment industry explaining why investors and clients should accept the mediocre results. “Bottom line,” according to them: you can’t do any better. Here is a brief summary:

S&P 500 Index Fund 1.38%

30 Year US Treasuries (-2.04%)

Barclay’s US Aggregate Bonds 0.55%

Cash (3 month T Bills) 0.11%

Commodities (Bloomberg Commodity Index) (-24.66%)

That is if you stick with convention. There are alternatives, but the investor needs to understand that the industry itself is offering traditional investment advice for a fee. They are not going to jeopardize the “fee” by admitting there are alternatives, such as Horse Cove Partners.

It’s a New Year. Maybe a time to shake things up? Try something different? We have no way of knowing how 2016 is going to turn out. But what if another year goes by without looking at fresh alternatives? As we have pointed out in past newsletters, there are very well respected opinions that 2015 was the first of what could likely be 7 or 8 years of net returns that are basically zero.

Using the returns above, on a portfolio of $1,000,000, a traditional asset allocation of 60% stocks, 35% bonds and 5% cash would have yielded a total return of 0.1195% for the year or $1,195. That is what conventional advice would have achieved for you on $1 million. Just $22.98 per week of income. If you had paid 1% per year for that advice, you would have lost money.

An allocation of 20% of the total portfolio to Horse Cove would have produced $40,840 of net return. Added to the above portfolio, adjusted to keep the same prorate allocation to stocks and bonds would have produced 4.18% for the year or $41,796. Almost 35 times more return.

We strongly believe that there is a better way to invest. It involves doing something different from what most everyone else is doing. That is the only way to achieve different…better results. Our track records stands in testament to that philosophy. We welcome the chance to show you how.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

Assets under management at the end of December 2015 were $18.793 million.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan, Michael Crissey and Greg Hyde

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

ghyde@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 12.31.2015, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.