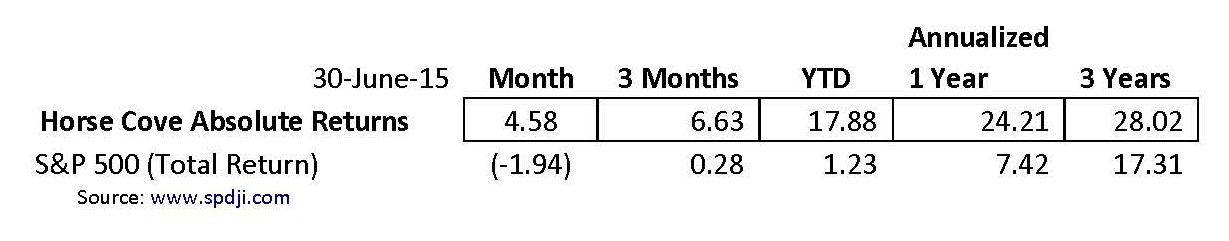

The month-end performance estimate, as of June 30, 2015 for Horse Cove Partners Absolute Return Strategy is +4.58%, net of fees1. Since the inception of trading in December 2010, the Strategy has achieved a total cumulative return of +208.15%.

Market Recap and Commentary

The S&P 500 Total Return Index had another negative month in June, down -1.94% for the month and is holding on to a slight gain year to date, up 1.23%. Horse Cove is up 17.88% year-to-date.

Volatility took a jump this month and in the last week, moved significantly. The VIX opened on June 1 at 15.43% and closed at 18.23%, with a low of 12.11 on June 23. But the real action came on the news that Greece was not able to negotiate another extension of its debt. From June 23 to June 29, the VIX rose 55% to top at 18.85%.

Monday, June 29, saw the S&P 500 Price Return Index declined 44.85 points. That was the largest single day decline since October 9, 2014. The Dow Industrials have ended the first half of the year at a loss, down 203 points. The S&P 500 is off to its worst 6 month start to a year since 2010.

Performance and Trading Update

With volatility rising, premiums for selling options got better as the month wore on. There was little margin pressure during the month, even with the decline at the end of June.

We wrote puts and calls on average 5.275% and 2.8% out of the money respectively. The strategy continues to handily out-perform the S&P 500 Total Return Index in all of the periods indicated:

IRA Update

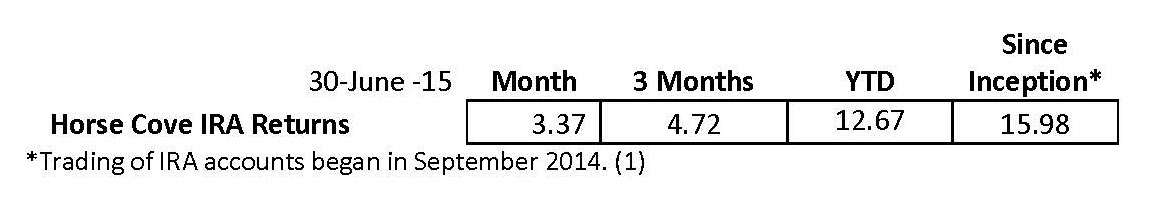

Here are the returns for the consolidated IRA accounts for the periods indicated:

IRA accounts must use Reg. T Margin which, means that fewer option contracts can be written than in the “regular” accounts that use Portfolio Margin. Over time, this will result in lower returns when compared to the “regular” accounts.

Milestones

This month, we want to thank our investors who have made it possible for Horse Cove Partners to reach a significant milestone in our firm’s growth.

We are very pleased that as of June 30, 2015, total assets under management exceeded $17.5 million. In this era of billion dollar hedge funds, $17.5 million may not sound so impressive. However, a brief history may provide some perspective. When we began trading in December, 2010 we had slightly over $300,000 of personal money. When we accepted our first client in January 2013, we had $1.3 million under management.

Including both new client assets and internal growth from performance, our growth rate has exceeded 170% per year for the past two and a half years.

While we cannot forecast a continuation of such phenomenal growth, we believe that we have answered the frequent question from prospective investors of “Does this strategy work?” This December will mark five years of trading the strategy. We will have traded through one of the five periods in the last 25 years where volatility has spiked above 40%. We have had only one negative quarter, and along the way, our first clients have seen their original investment more than double.

We know that we have many potential investors who are still “watching” and “waiting” to invest. While they have been “watching” (some for over two and a half years), Horse Cove has produced performance that has substantially exceeded all major indices and all but a handful of all other managers, regardless of investment style or asset class.

Again, we want to thank our investors who have trusted us with a portion of their assets. We will continue to work very hard to justify that trust. We also hope that investors who are “watching” will invest with us soon, so that they may start receiving the significant out-performance Horse Cove can produce.

If you would like to learn more, please contact us. We would welcome the opportunity to work for you.

Horse Cove Update

The United States Patent and Trademark Office, officially awarded Horse Cove Partners a service mark for “Profiting from the Art and Science of Taking Risk” ® on June 9, 2015.

Horse Cove Partners added four new clients this month and has three more working on their new accounts for a July start.

Total assets under management now exceed $17.59 million in the Horse Cove Absolute Return Strategy.

We value each of our clients and the assets each has entrusted to us in our Strategy. We will continue to pursue attractive returns to the benefit of all.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow clients’ assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan and Michael Crissey

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

mcrissey@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 6.30.2015, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.