The month-end performance estimate as of October 31, 2014 for Horse Cove Partners Absolute Return Strategy is -7.52%, net of fees1. For 2014 year to date, the strategy return is +7.88%, and since the inception of trading in December 2010, the strategy has achieved a total cumulative return of +148.60%.

Market Recap and Commentary

October was the first stumble in the bull market with the first significant correction and rise in volatility that was completely reversed in the month. From start to finish, the S&P 500 Price Index rose 2.32% from an opening of 1971.44 and closed at an all-time high of 2018.05. During the month there were 12 trading days that the market change was +/- 1% or more.

The S&P 500 had one of the largest intra-month reversals since 1970 during October, bottoming down at -7.69%; to close up 2.32% at month end. Courtesy of Ryan Detrick, it was the fifth largest intra-month reversal to end in the green in the last 54 years. That kind of “V” shaped reversal is unusual and came at a time when the Federal Reserve ended it quantitative easing.

Some “experts” have commented that the “correction” in October was the pullback the bulls were waiting for. We are concerned by what feels like a parabolic rise without underlying support.

Performance and Trading Update

Trading in October was very challenging and the loss reflects that fact. While the strategy remains positive for the year, the loss for the month was disappointing and one that will take a few weeks to reverse. Losses are a fact of trading, but with higher volatility will come the opportunity to obtain higher premiums, thus allowing for a shorter period of time to make up the drawdown.

We started the month of October trading with the VIX at 16.44%. On October 15, it hit its monthly high of 31.06%, only to end the month two weeks later at 14.03%. This whipsaw in the market and volatility resulted in our suffering trading losses on the put side the week ending October 18, 2014, and the call side for the week ending October 31, 2014 (Halloween). In addition, our prime broker does all of the calculations for our fees. They do not accrue performance fees each month; rather deduct the entire previous quarter’s performance fee after the quarter end. So we started October for reporting purposes, down -1.6%.

Our trading strategy is based on the statistical probability of the market moving a certain percentage during our option writing cycle. In both weeks where we booked losses, the market closed at levels that would not have put our positions “in-the-money”. For the week of expiration on October 18, we originally wrote the 1840 puts. The market closed at 1862.49. However, we rolled down earlier in the week when the probability was no longer in our favor, booking a known loss and reducing risk rather than taking a risk that the market would reverse.

Similarly, in the last week of trading, we had written the bulk of our calls at the 2020 strike price. After managing the risk as the market shot upwards, we ended up booking losses when the probability went below 70%--only to have the market close at 2017.81. Again, the options would not have been in the money, but we are unwilling to take an unprotected loss with the odds less than 66% even if it’s the last day of trading.

Our conclusion is: the statistical foundation upon which the strategy is based, remains valid.

We speak of intelligent losses. By that we mean: we actively manage risk so that we have another week to write options and collect premiums. Part of that risk management is to take action to exit a trade and change the risk exposure when the probability of the trade being “in-the-money” falls to 66%.

We stuck to that discipline this month, and it resulted in losses. Had we taken a gambler’s risk, the losses would have been significantly less or perhaps not at all. However, that is a strategy that could lose everything--not the way we trade.

Given the margin pressure that we saw from Interactive Brokers during the month, we are easing up slightly in the collateral usage to permit more margin “breathing room” given all the up and down 1% moves the market is putting in.

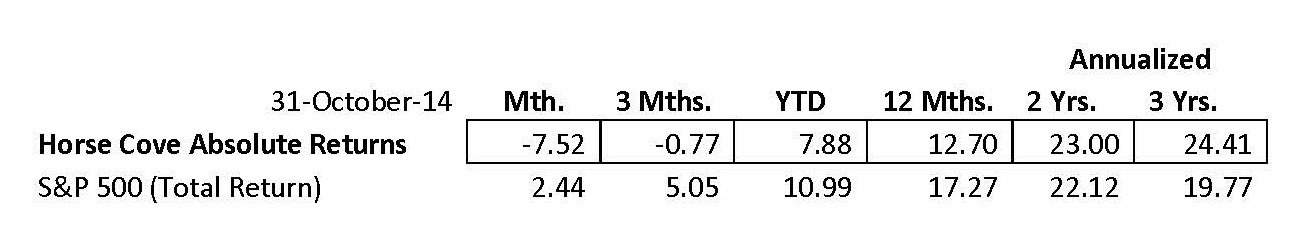

Here are the returns versus the S&P 500 total return index for the periods indicated:

Of Paper Cuts and Lemon Juice

We hate to report losses. But they are a fact of our business. We talk about our philosophy of taking intelligent losses. If risk is “effectively managed losses”, they are like paper cuts. Even with some lemon juice rubbed in! While they sting and are painful at the time, they are very rarely fatal.

We are reminded of a quote from one of the world's greatest traders, George Soros:

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong."

When you're trading, especially in crises, it's easy to lose too much money when you're wrong. We know that a bad situation can get worse. Our strategy is to earn a profit in more weeks than we lose, and our trading history is proving effective in just this way.

Horse Cove Update

We welcomed one new client this month. The total assets under management now exceed $8.3 million in the Horse Cove Absolute Return strategy. As a firm, including assets under management in our affiliated firm, we are currently responsible for just under $15 million of assets.

We value each of our clients and the assets they have entrusted to us in our strategy and will continue to pursue attractive returns to the benefit of each and every one.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk.®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December of 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on probability of success and the management of risk. We believe that it is possible to realize positive returns through disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We would like to thank you for your continued support and look forward to being in touch with you in the near future.

Sincerely,

Sam DeKinder, Kevin Ellis

John Monahan

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

jmonahan@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis as of 10.31.2014, which is preliminary and subject to revision. Performance estimate described herein as “YTD” are net of fees and expenses including a 2% per year management fee and 20% incentive fee and also assumes investors have been invested with no withdrawals.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (978) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND OF ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as an investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

Finally, to the extent that performance information is contained in this message, you are hereby advised, and you acknowledge it, that past performance does not assure future results, which are not guaranteed by Horse Cove Partners LLC or any of its affiliated entities or by any insurance mechanism.

IRS CIRCULAR 230 NOTICE. Any advice expressed above as to tax matters was neither written nor intended by the sender or any Horse Cove Partners LLC affiliated entities to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed under U.S. tax law.