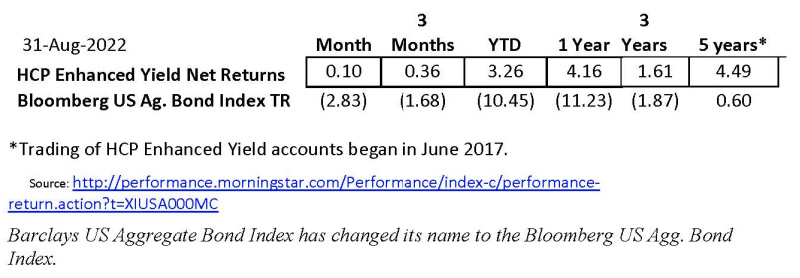

The August 31, 2022, month-end performance estimate for the Horse Cove Partners Enhanced Yield Strategy was up 0.10% net of fees1. Since the June 2017 inception of trading, the Enhanced Yield Strategy has achieved a total cumulative return of +26.52% net of fees.

Fixed Income Commentary

Yields continued to rise and inflation remained stubbornly high during August. The hawkish tone from Federal Reserve Chairman Powell at the annual Jackson Hole conference took its toll on traders with the S&P 500 Total Return Index down (4.08%).

The Bloomberg US Aggregate Bond Index TR was significantly negative for the month, down (2.83%). Bond investments continue to struggle under the rising rates being pushed by the Federal Reserve Board. The net returns for the Bloomberg US Aggregate Bond Index ending in August are negative for the month, 3 months, year-to-date, 1-year period, and 3-year periods.

Source: http://bloomberg.com/quote/LBUSTRUU:IND

Unless you are shopping for a house, there has been little attention drawn to the fact that nationally, the average 30-year mortgage rate was 6.07% as of September 8, 2022. Source: https://www.forbes.com/advisor/mortgages/mortgage-rates-09-06-22/. That is up over 108% in one year ending on September 7, 2022, according to Mortgage News Daily.

The benchmark 10-year US Treasury Note yield rose in August by almost 18%, closing at 3.15%. For the year to date, the yield on the 10-year US Treasury has risen by over 90%.

Performance Update

Horse Cove Partners Enhanced Yield Strategy composite was slightly positive at 0.10% net of fees in August.

The equity markets had a big turnaround in July. That one-direction market and declining VIX left no appetite for buyers of significantly out-of-the-money puts. Despite multiple weeks of attempting to sell premiums, there simply were no trades that were filled.

Here are the composite net returns for the Enhanced Yield Strategy for the periods indicated:

Source: http://bloomberg.com/quote/LBUSTRUU:IND

Bloomberg US Agg. Bond Index formerly known as Barclays US Aggregate Bond Index.

The Enhanced Yield Strategy is intended to serve as a complement to a fixed income portfolio by adding alpha with low correlation to traditional bond portfolios. The strategy employs an overlay approach to option selling by holding a core portfolio of short-term U.S. Treasury securities that are used as collateral to sell significantly out of the money put options on the S&P 500 Index. The strategy can also be used as an overlay on a long equity portfolio for clients seeking to add incremental non-correlated returns.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk. ®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow the client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December 2010. The firm is built on the strength of hedge fund trading expertise developed beginning in 2002.

The firm offers clients multiple option strategies, including overlay strategies on equity and bond portfolios as well as: Absolute Returns, which commenced trading in December 2010, Enhanced Yield, which began trading in June 2017 and Money Plus, which began trading in August of 2020.“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on the probability of success and the management of risk. We believe that it is possible to realize positive returns through a disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

We thank you for your continued support.

Sincerely,

Sam DeKinder, Kevin Ellis

Greg Brennan

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

gbrennan@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

1Net estimate on a consolidated basis of similar accounts as of 8.31.22, which is preliminary and subject to revision. Performance estimates described herein as “YTD” are net of fees and expenses including a 2% per year management fee and assume investors have been invested the entire time with no withdrawals. Individual account returns may vary depending on cash flows, the time period assets are invested, and restrictions placed on the account.

This was prepared by Horse Cove Partners LLC a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Additional information about our firm is also available at www.adviserinfo.sec.gov. You can view the firm’s information on this website by searching by our firm name.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (678) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

This material has been prepared solely for informational purposes only. Strategies shown are speculative, involve a high degree of risk, and are designed for sophisticated investors.

Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The information herein was obtained from third-party sources. Horse Cove does not guarantee the accuracy or completeness of such information provided by third parties. All information is given as of the date indicated and believed to be reliable. Performance results are estimates pending verification. The returns are based on the Investment Manager's strategy and the compilation of actual client account trades. The Horse Cove Absolute Return and IRA Return strategies seek to extract absolute returns from the market by trading short volatility option spreads. The Enhanced Yield strategy seeks to achieve a targeted return trading only puts with a high probability of success.

The strategies reflect the deduction of advisory fees and any other expenses that a client would have paid or actually paid. The S&P 500 Index is used for comparative purposes only. The volatility of an index is materially different from that of the model portfolio. The S&P 500 refers to the Standard and Poor's 500 Index which is a capitalization-weighted index of 500 stocks. The index is designed to measure the performance of the broad domestic stock market. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward-looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Options trading entails a high level of risk. The models do not include the reinvestment of dividends and capital gains because options don't pay dividends. Please read the Characteristics and Risks of Standardized Options available from the Options Clearing Corporation website: http://www.optionsclearing.com for further details.