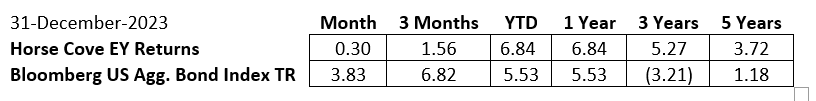

The Enhanced Yield Strategy was up 0.30%.

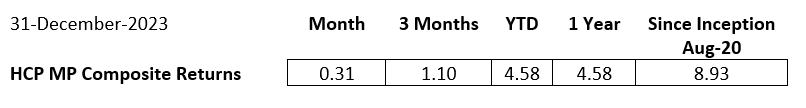

The Money Plus Strategy was up 0.31%.

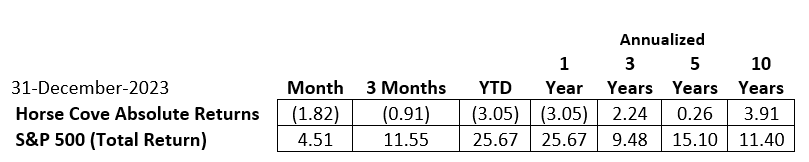

The Absolute Return Strategy-Composite Portfolio Margin was down 1.82%.

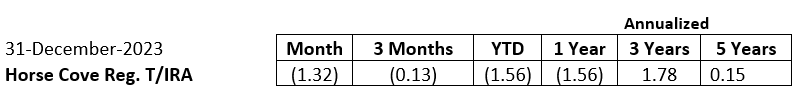

The Absolute Return Strategy-Composite Reg. T Margin was down 1.32%.

Market Recap and Commentary

The S&P 500 posted an impressive 24.23% return in 2023, most of which was delivered in just a few months and by a handful of stocks. This small group of stocks, (Tesla, Nvidia, Amazon, Meta Platforms, Microsoft, and Alphabet) now being called the “Magnificent 7” had an average total return gain of 104.7% in 2023. The last two months of the year delivered a historic rally on the back of an unexpected pivot in FED talking points delivered by Jerome Powell. Investors and institutions went all-in on a soft landing for the economy and bought everything. After 2022’s loss of just over 18% that leaves the two-year return for the S&P at .08%, or just over 3% including dividends.

There is no question that this was a difficult environment for trading our strategy. Looking forward we would expect some volatility in the first half of the year. It remains to be seen whether the soft-landing narrative plays out as expected. The data itself will either support or negate its validity. We also expect significant uncertainty surrounding the upcoming election. Whether the market stabilizes and continues with a steadier growth pattern going forward or we get a significant pullback to consolidate the historic rally in November/December our options strategy is poised to take full advantage of either scenario.

There are, as always, a few things to keep in mind as an investor. A soft landing is expected, therefore priced in, but has not been realized and there are plenty of economic data dumps ahead of us that will flesh that out. War in the Middle East continues to escalate with no end in sight as fear grows of other players being pulled in. On top of that, governments, corporations, and consumers have saddled themselves with record amounts of debt that are now being serviced at significantly higher rates. The debt service for the US government, with its now $34 trillion in debt, exceeds the expense of every other program excluding welfare but is not far off.

Looking ahead to 2024 we appear to be in an extremely binary outcome situation. While there are many things to be positive about, the wall of worry could prove to be troublesome and provide a rocky road to the destination. Let’s see what the world chooses to focus on.

Wishing you all a prosperous and happy New Year.

Performance Updates and Benchmarks

Here are the composite net returns for the Enhanced Yield Strategy for the periods indicated:

Bloomberg US Agg. Bond Index formerly known as Barclays US Aggregate Bond Index.

*Trading of HCP Enhanced Yield accounts began in June 2017.

Source: http://bloomberg.com/quote/LBUSTRUU:IND

Here are the composite gross returns for the Money Plus Strategy for the periods indicated:

*Trading of HCP Money Plus Strategy began in August 2020. Composite returns effective September 1, 2021. According to the new marketing rule, gross fees may only be shown with net fees.

Here are the composite net returns for the Absolute Return Strategy-Portfolio Margin for the periods indicated:

Source: www.spdji.com

*Trading of HCP Portfolio Margin accounts began Dec. 2010.

Here are the composite net returns for the Absolute Return Strategy-Reg. T for the periods indicated:

*Trading of HCP Reg. T. accounts began in Sept. 2014.

IRA accounts must use Reg. T Margin which means that fewer option contracts may be written than in the “regular” accounts that use Portfolio Margin. Over time, this may also result in lower returns when compared to the “regular” accounts.

About Horse Cove Partners LLC

Profiting from the art and science of taking risk. ®

Horse Cove Partners was founded by Sam DeKinder and Kevin Ellis in January of 2013 with the commitment to help grow the client’s assets with a highly disciplined investment strategy, replicated weekly, to extract absolute returns from the market by trading short volatility option spreads. The firm was launched after more than two years of trading experience with personal assets that began in December 2010. The firm is built on the strength of over 20 years’ experience in hedge fund trading, beginning in 2002.

The firm offers clients multiple option strategies, including overlay strategies on equity and bond portfolios as well as: Absolute Returns, which commenced trading in December 2010, Enhanced Yield, which began trading in June 2017, and Money Plus, which began trading in August 2020.“We do not believe we are smarter than the market, nor can we time the market in any given week or month. As a result, we take an investment approach similar to an insurance company in that our investment strategy focuses on the probability of success and the management of risk. We believe that it is possible to realize positive returns through a disciplined focus on the risk of each trade with a weekly investment horizon, and accepting intelligent losses when risk events occur.”

– Sam DeKinder and Kevin Ellis

We thank you for your continued support.

Sincerely,

Sam DeKinder, Kevin Ellis

Greg Brennan

Don Trotter

sdekinder@horsecovepartners.com

kellis@horsecovepartners.com

gbrennan@horsecovepartners.com

dtrotter@horsecovepartners.com

Horse Cove Partners LLC

1899 Powers Ferry RD SE

Suite 120

Atlanta, GA 30339

678-905-5723 main

Net performance on a consolidated basis of accounts as of 12.31.2023. Performance described herein are net of fees and expenses including a 2% per year management fee for the company’s Absolute Return Portfolio Margin Strategy, Absolute Return Reg. T Strategy, and the Enhanced Yield Strategy, and a 1% per year management fee for the Money Plus Strategy. Performance for each of the company’s strategies assumes investors have been invested the entire time with no withdrawals.

This was prepared by Horse Cove Partners LLC a registered investment adviser in the state of Georgia. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT ARE CONFIDENTIAL AND PRIVILEGED. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE NOTIFY THE SENDER IMMEDIATELY AT 1 (678) 905 5723. IF YOU ARE NOT THE NAMED ADDRESSEE YOU SHOULD NOT COPY OR DISCLOSE THE CONTENT OF THIS MESSAGE AND ANY FILES TRANSMITTED WITH IT TO ANY OTHER PERSON.

Internet communications are not secure and subject to possible data corruption, either accidentally or on purpose, and may contain viruses. The content of this message should not be construed as investment advice unless explicitly stated as such in the text of this message. Further, this message should not be construed as the solicitation of an offer to purchase or an offer to sell any securities or other financial instruments, including, without limitation, interest in any private investment managed by Horse Cove Partners LLC or any of its affiliated entities.

This material has been prepared solely for informational purposes only. Strategies shown are speculative, involve a high degree of risk and are designed for sophisticated investors.

Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The information herein was obtained from third party sources. Horse Cove does not guarantee the accuracy or completeness of such information provided by third parties. All information is given as of the date indicated and believed to be reliable. The returns are based on the Investment Manager's strategy and the compilation of actual client account trades. The Horse Cove Absolute Return and IRA Return strategies seek to extract absolute returns from the market by trading short volatility option spreads. The Enhanced Yield strategy seeks to achieve a targeted return trading only puts with a high probability of success.

The strategies reflect the deduction of advisory fees and any other expenses that a client would have paid or actually paid. The S&P 500 Index is used for comparative purposes only. The volatility of an index is materially different from that of the model portfolio. The S&P 500 refers to the Standard and Poor's 500 Index which is a capitalization-weighted index of 500 stocks. The index is designed to measure the performance of the broad domestic stock market. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward-looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Option trading entails a high level of risk. The performance numbers do not include the reinvestment of dividends and capital gains because options do not pay dividends. Please read the Characteristics and Risks of Standardized Options, available from the Options Clearing Corporation website: http://www.optionsclearing.com for further details.